Mortgage Review for Joseph Christian

Hi, Joseph!

Thank you for speaking with me earlier.

I have updated the options to show what your possible budget could look like if you wanted to increase your down payment, all while keeping your payment around the $1500/mo. I went up as high as the $450k purchase price just so you can see what that could look like, but we also can look at figures in between these amounts if you’d like.

Regarding the loan side of things, now that we have established you would like to keep the payment around $1500/mo we can set up the needed income to get approval through underwriting and satisfy the mortgage requirements for your debt-to-income.

1. We’ll eventually need your Social Security award letter. You may have received one already stating what your benefits will be next year. Usually, those letters are mailed to you in Nov or Dec. If you have that letter please send that over. If you don’t have that letter, I can also use the tax form you receive called a 1099.

2. You’ll need to set up a monthly distribution from your annuity account. The monthly distribution will need to be $2,000/mo. Here are the steps to get that process going:

– On your annuity statement, there should be a customer service number. You’ll call the number and speak to a customer service representative or one of their licensed financial advisors.

– When you get one of them on the phone, let them know you need to set up a $2000/mo recurring distribution. They should walk you through the steps of what they need next.

– Once you work through that with the representative, request they send you a copy of the “distribution letter” or it can also be called an “award letter” and they should be able to email, fax, or mail that to you. Hopefully, they can just email it.

– Once you receive the letter, you can forward it to me by email, text or however you’d like

– You’ll need to receive at minimum one of the distributions as a requirement for underwriting. As I mentioned, once your pension kicks in, you can cancel this distribution if you’d like. There’s no follow-up after the loan has closed to check income sources or anything like that.

**Note if you have trouble getting the distribution set up, let me know. I have a licensed financial advisor that’s located right here in the Phoenix area that can help you**

Other Items I’ll need to collect:

1. Most recent 3 statements from your Annuity. You may also get your annuity statements quarterly instead of monthly, so in that case, just send your most recent statement

2. Most recent 2 statements from the checking/savings account where the $200k proceeds money is sitting.

That is all I’d need for right now. After you find a home and negotiate and get a contract to purchase there will be other items I’ll update you with when that time comes.

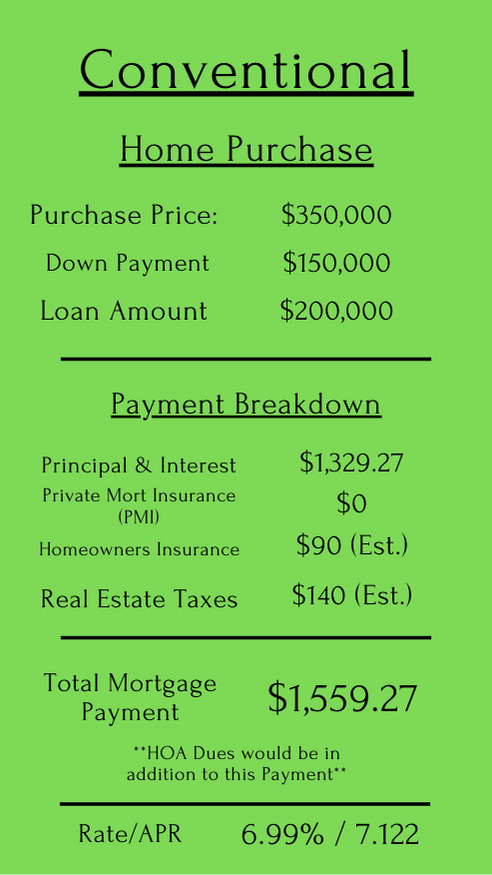

Conventional Financing – $350,000 Purchase Price – Keeping payment around $1500/mo

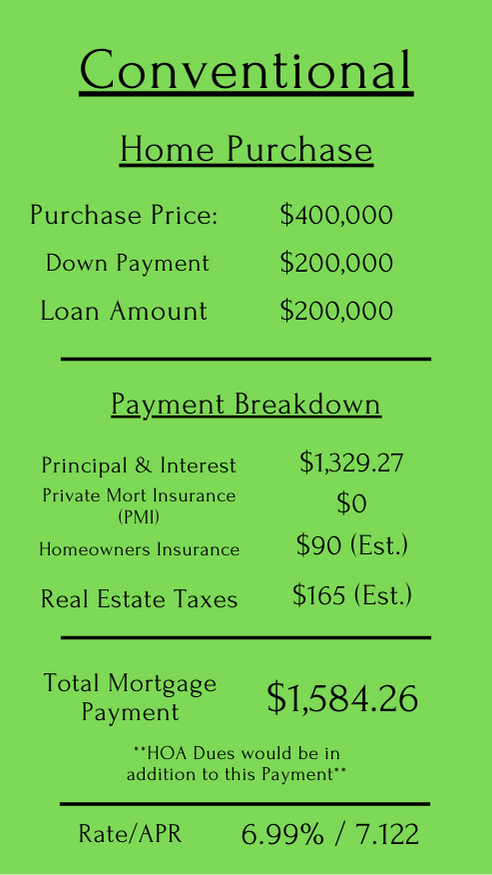

Conventional Financing – $400,000 Purchase Price – Keeping payment around $1500/mo

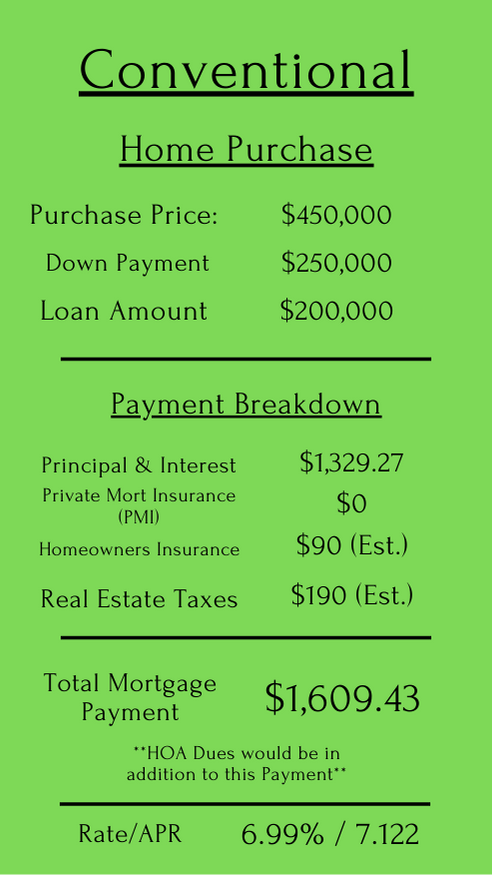

Conventional Financing – $450,000 Purchase Price – Keeping payment around $1500/mo